Homeowners often fear a rate increase after filing a roof damage claim. Insurance premiums can rise due to factors such as roof age, extensive claims, and location risks. Older roofs are viewed as high-risk, while areas prone to severe weather may face heightened costs. Even minor claims can impact future premiums. It's essential to understand these factors and their implications, which can uncover ways to manage costs effectively. More understanding on managing these situations await.

How can homeowners traverse the complexities of roof repair expenses and their insurance ramifications? Understanding roof repair costs begins with recognizing several factors. Material costs vary widely; asphalt shingles are typically less expensive than slate or tile. The extent of damage also plays a significant role, with minor repairs costing less than major structural issues. Roof material can significantly influence repair costs, as different types may require specialized labor and varying amounts of investment. Labor costs can range from $45 to $75 per hour, depending on local building codes and contractor rates. Homeowners should also factor in roof maintenance costs, as regular upkeep can prevent more extensive damage and save money in the long run. Additionally, understanding insurance implications, such as deductibles and coverage limits, is essential for making informed decisions regarding claims for roof repairs. A well-planned remodeling process can also help homeowners identify and address potential roof issues before they escalate.

As roofs age, their condition becomes a critical factor influencing homeowners' insurance premiums. Roofs that are over 15-20 years old are often deemed high-risk, leading to increased premiums due to a greater likelihood of damage claims. Insurance companies take roof age seriously, as older roofs are more prone to leaks and structural issues, which can result in costly repairs. The link between old roofs and susceptibility to storm damage can further exacerbate insurance costs, as insurers face higher payouts during extreme weather events. Homeowners can mitigate some risks by maintaining their roofs and keeping thorough roof maintenance documentation. The durability of roof materials also plays a significant role in insurance costs; newer, high-quality materials may qualify for discounts. For example, using materials made for Texas weather can enhance roof longevity and reduce insurance costs. Regular inspections and maintenance not only support claims but can also demonstrate responsible homeownership, potentially resulting in lower insurance premiums over time.

What factors contribute to the variation in insurance rates based on location? Insurance premiums can differ significantly, influenced by local building codes and neighborhood development. Areas prone to natural disasters, such as hurricanes or wildfires, often face higher rates due to increased risk of damage. Additionally, homes situated in neighborhoods with high crime rates typically see augmented insurance costs. The proximity to hazards, like floodplains, also impacts premiums. Furthermore, local building codes may require stricter construction practices, sometimes resulting in higher insurance rates. Conversely, neighborhoods undergoing development may benefit from improved infrastructure, potentially reducing risks and costs. Understanding these factors helps homeowners grasp how their location influences insurance rates, enabling them to make informed decisions. Notably, population density can also play a significant role in determining insurance costs, as higher density areas often see increased rates due to risks like traffic and accidents.

Severe weather significantly influences the frequency and impact of roof damage claims, particularly from convective storms such as hail and strong winds. In recent years, these storms have resulted in substantial financial losses, underscoring the vulnerability of roofs across various regions. Understanding the relationship between severe weather events and insurance claims equips homeowners to better prepare for potential damages and navigate the claims process more effectively. Additionally, working with experienced contractors like TriStar can ensure that any necessary repairs are executed with commitment to craftsmanship, providing peace of mind during the recovery process.

Convective storms play a significant role in the increasing number of roof damage claims filed by homeowners across the United States. These storms, influenced by climate change impacts, exhibit notable storm severity trends. Key factors contributing to roof damage include:

Understanding these elements helps homeowners maneuver the intricacies of insurance after experiencing roof damage.

Hail damage poses a significant threat to roofs across the United States, with millions of properties affected each year. States like Texas and Kansas lead in hailstorm frequency, contributing to a high hail damage probability. In 2019 alone, over 7.1 million properties experienced damage, resulting in more than $13 billion in losses. The severity of hail events has also escalated, with record claims emerging from regions once considered safe. As hail exposure increases, roofs age prematurely, complicating insurance claims. Property owners may not always recognize hidden damage, placing added pressure on insurers. Understanding the implications of hail storm frequency and severity helps homeowners take proactive measures to protect their investments and traverse potential insurance claims effectively.

In recent years, homeowners have witnessed significant changes in insurance coverage and premium structures related to roof damage. These shifts reflect a move toward greater policy transparency and consistent underwriting practices. Homeowners should be aware of the following key trends:

As these changes unfold, homeowners must stay informed to manage their insurance options effectively.

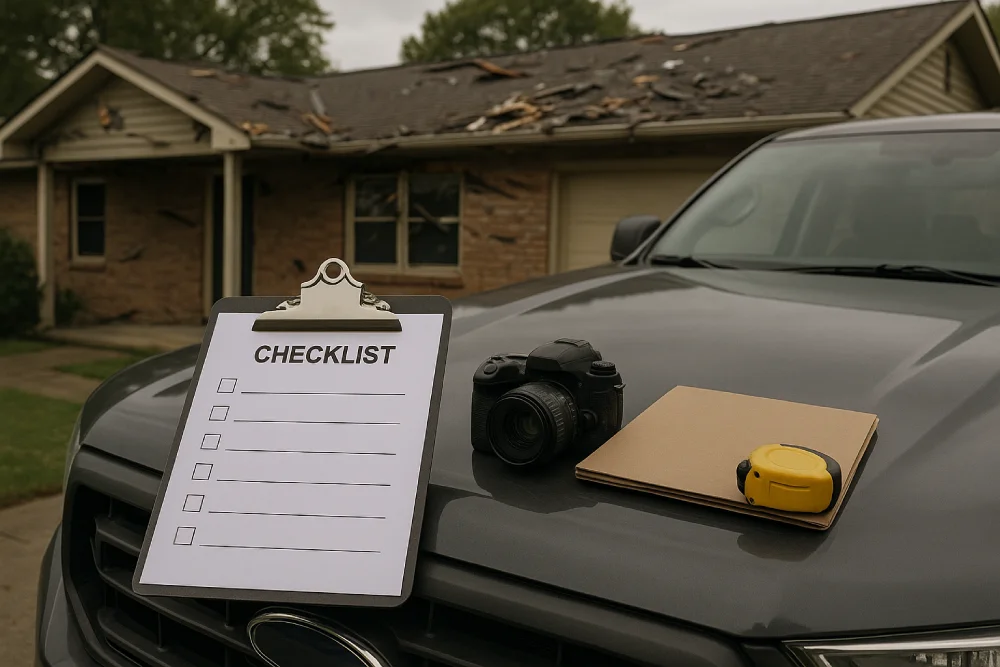

After filing a roof damage claim, homeowners can expect a structured process that typically spans several weeks. The claims process involves stages such as damage reporting, adjuster inspections, and payment disbursement, each with specific timelines. Being aware of potential rate increases in the future is crucial, as filing a claim may impact insurance premiums in the long run.

Understanding the claims process for roof damage can provide homeowners with a sense of control during a challenging time. After filing a claim, homeowners can expect several key steps:

These steps help guarantee a smooth claim investigation and can significantly influence the claim outcome. Staying organized and proactive during this process is essential for homeowners seeking fair compensation for roof damage.

Filing a roof damage claim can lead to unexpected changes in homeowners' insurance premiums. The severity of the claim significantly influences potential rate increases. For instance, claims involving extensive damage may result in higher premium hikes compared to minor claims. Additionally, the policy renewal timeframe can reveal these changes, as premium adjustments often become evident during renewal periods. Locations with high risks, like severe weather or crime, may see larger increases. Frequent claims may also flag homeowners as higher risk, leading to further rate hikes. Ultimately, understanding these factors helps homeowners prepare for potential changes in their insurance premiums after filing a claim, ensuring informed decisions about their coverage.

As the terrain of insurance evolves, the future of roof damage assessments is becoming increasingly sophisticated, shaped by technological advancements and stricter regulations. Insurers are adopting innovative inspection technologies to enhance accuracy and efficiency. Key trends include:

These developments promise to reshape how insurers assess roof damage, ultimately benefiting both carriers and homeowners through more informed decisions and fairer premiums.

In summary, it's crucial for homeowners to grasp how roof damage can impact their insurance rates. By taking into account factors such as the age of your roof, your geographical location, and any weather-related claims, you can navigate your insurance options more effectively. After you file a claim, staying informed about any potential changes to your coverage and premiums is key. The insurance landscape can be unpredictable, but being proactive will help you make well-informed decisions and prepare for any challenges ahead.

At TriStar Built, a locally owned and insured construction company based in North Texas, we pride ourselves on our quality-first approach and long-term relationships with our subcontractors. Our client-focused service means we’re here to guide you through every step, ensuring that your needs are met with craftsmanship you can trust.

Your credit score can directly affect your insurance rates, including homeowners insurance premiums, especially after filing a roof damage insurance claim. Many insurance companies keep track of credit-based risk scores, and if your score is lower, your homeowners insurance will go up after a claim, even if the damage insurance claim was legitimate. It’s important to understand how your financial background plays into the way insurance companies can adjust rates following a property damage claim.

After you file a roof claim, your insurance company may not change your deductible immediately. However, some home insurance policies allow for deductible adjustments over time, especially if you've filed multiple claims within a short period. While one single claim may not affect your deductible, filing a homeowners insurance claim repeatedly might trigger updates. Before proceeding, it's wise to ask your insurance agent for clarity on your policy’s terms and whether a roof replacement claim will impact your deductible long-term.

Yes, homeowners can challenge insurance premium increases after repairs by gathering documentation and submitting it to their insurance provider or insurance adjuster. If your insurance premium will go up after a claim, especially when you've never filed a claim before, you may be eligible for claim forgiveness depending on your insurance policy that covers roof damage. If necessary, contact your state insurance department or consult your insurance agent to help you navigate the claims appeal process effectively.

Many insurance companies now use advanced technologies like satellite imaging and AI modeling to inspect the roof remotely. This helps determine whether the type of claim you file qualifies for compensation. The process is often used for roof claims on your insurance, especially in areas like Florida where homeowners file more frequently due to weather conditions. Remote evaluations can also influence how quickly the insurance company to cover your damage makes a decision, especially for a full roof replacement.

Yes, installing a new roof may lead to discounts on your homeowners insurance premium, especially if high-quality, impact-resistant materials are used. Homeowners know that taking steps to prevent future damage often lowers risk profiles, meaning insurance companies may offer incentives. Whether or not your homeowners insurance will adjust your rate depends on the materials, the roofing company, and the overall type of claim. Always verify with your insurance carrier to confirm eligibility and avoid surprises down the line.

Whether you’re remodeling a home, expanding a business, or starting from the ground up, TriStar Built is here to guide you every step of the way. With a focus on craftsmanship, communication, and results that last, we make the construction process clear, smooth, and worth every investment.

LOCATION: 2126 James Street, Denton, TX 76205

PHONE: (940) 381-2222

© 2025 TRISTAR BUILT - ALL RIGHTS RESERVED | WEB DESIGN & SEO BY: Authority Solutions®